What does it include?įrom AY 2023-24 onwards, Form 26AS will include every transaction where tax has been deducted (TDS) from a person’s income, be it by their employer or a bank, or any other person, and tax that has been collected (TCS) from a person.

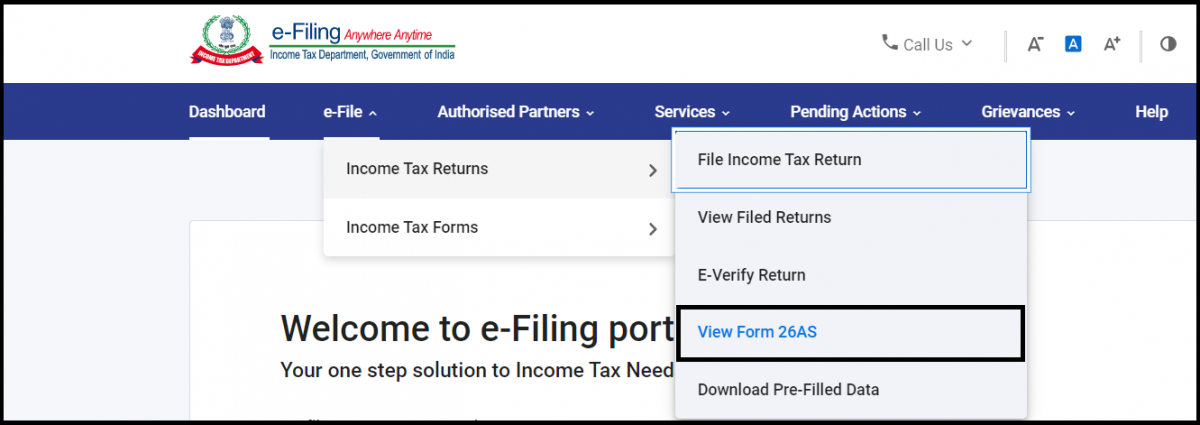

Form 26AS can be accessed by a taxpayer from the Income Tax Portal using the PAN.

0 kommentar(er)

0 kommentar(er)